The Japanese Cabinet Office have just released another report on the state of the Japanese economy. Unsurprisingly they one more time draw attention to the lacklustre state of Japanese domestic consumption:

the report, which looks at a variety of economic factors besides gross domestic product, warned of weakness in consumer spending, saying sluggish growth in wages was keeping spending flat.

Domestic demand, which accounts for more than half the economy, undercut growth in the July-September quarter, forcing the government to downgrade its economic outlook earlier this month.

The latest report echoes concerns that although Japan has emerged from a decade-long economic stagnation — with robust exports contributing to record profits at Japanese companies — those profits have not driven up wages and spending.

The Japanese economy's recent growth is also less stellar than the double-digit growth it experienced from the late 1960s. The economy grew at an annualized pace of 0.8 percent in the third quarter.

Prime Minister Shinzo Abe later told reporters that he would work to realize economic growth that "can be felt by the general public."

The BoJ governor Toshihiko Fukui was unusually downbeat:

"We can keep an accommodative monetary environment led by very low interest rates for some time," Fukui told business leaders at a year-end meeting of the Japan Business Federation, also known as the Nippon Keidanren.

"We will tighten monetary policy if economic activity and prices develop in line with our projections," he said.

My feeling is that they are worried, not rattled, but worried, and they have reason to be. If cLuas and I are right here, and domestic demand isn't going to recover as anticipated, there are important policy changes to be made, and if they are to be effective these need to be made sooner rather than later.

Facebook Blogging

Edward Hugh has a lively and enjoyable Facebook community where he publishes frequent breaking news economics links and short updates. If you would like to receive these updates on a regular basis and join the debate please invite Edward as a friend by clicking the Facebook link at the top of the right sidebar.

Monday, December 25, 2006

Thursday, December 21, 2006

Japanese Exports Continue To Power Ahead

Japan's export growth accelerated in November:

Exports rose 12.1 percent, helping the trade surplus widen to 915.9 billion yen ($7.7 billion) from 594.4 billion yen a year earlier, the Ministry of Finance said today in Tokyo. Imports gained 7.5 percent, down from 17.5 percent in October.

The yen's decline against the dollar and euro has helped reduce the effects of slower overseas demand, bolstering exports. Shipments abroad grew at the slowest pace in six months in October, causing concern that the economy would stall amid sluggish consumer spending at home.

The reason for the increase isn't too hard to pin down:

``There is no doubt that the yen's weakness remains an engine for Japan's exports,'' said Yoshimasa Maruyama, an economist at BNP Paribas. ``Today's numbers confirm Japan's exports maintain more momentum than we had expected.''

and there is evidence that relative movements in currencies are being reflected in the differing rates of increase to the receiving countries:

Exports to the U.S. climbed 8.6 percent, the slowest in five months. Shipments to the European Union accelerated to 12.9 percent from 8.7 percent. Exports to China quickened to 19.5 percent from 18.3 percent.

The yen is trading about 7 percent below the average rate last year, making Toyota cars and other Japanese goods cheaper abroad. The yen has fallen 7 percent against the euro in the past six months, buoying the value of imports. Exports to the region measured by volume, which don't take into account price changes, only grew 2.9 percent in November.

That is you only get the relatively higher number for the euro region (12.9% vs 2.9% when you take into account the yen value of products sold in dollars). Then note the following:

Japan's economy expanded an annual 0.8 percent in the third quarter and would have shrunk if it weren't for strong export growth and corporate spending on factories and equipment. Consumer spending, which accounts for more than half of the economy, had the biggest decline in almost a decade.

Not only is the Japanese economy dependent on an export model, but it will actually start to shrink if exports lose momentum. So while this is not the full recovery everyone has been expecting, it is sustainable, just as long as the export growth continues. Quite a delicate situation, and one which explains the sensitivity of Japanese stocks and bonds to each and every jitter in the United States. Given that they are now becoming more and more dependent on Europe, I guess the sustainability of Germany's recovery is now also very much a matter of concern to them.

Exports rose 12.1 percent, helping the trade surplus widen to 915.9 billion yen ($7.7 billion) from 594.4 billion yen a year earlier, the Ministry of Finance said today in Tokyo. Imports gained 7.5 percent, down from 17.5 percent in October.

The yen's decline against the dollar and euro has helped reduce the effects of slower overseas demand, bolstering exports. Shipments abroad grew at the slowest pace in six months in October, causing concern that the economy would stall amid sluggish consumer spending at home.

The reason for the increase isn't too hard to pin down:

``There is no doubt that the yen's weakness remains an engine for Japan's exports,'' said Yoshimasa Maruyama, an economist at BNP Paribas. ``Today's numbers confirm Japan's exports maintain more momentum than we had expected.''

and there is evidence that relative movements in currencies are being reflected in the differing rates of increase to the receiving countries:

Exports to the U.S. climbed 8.6 percent, the slowest in five months. Shipments to the European Union accelerated to 12.9 percent from 8.7 percent. Exports to China quickened to 19.5 percent from 18.3 percent.

The yen is trading about 7 percent below the average rate last year, making Toyota cars and other Japanese goods cheaper abroad. The yen has fallen 7 percent against the euro in the past six months, buoying the value of imports. Exports to the region measured by volume, which don't take into account price changes, only grew 2.9 percent in November.

That is you only get the relatively higher number for the euro region (12.9% vs 2.9% when you take into account the yen value of products sold in dollars). Then note the following:

Japan's economy expanded an annual 0.8 percent in the third quarter and would have shrunk if it weren't for strong export growth and corporate spending on factories and equipment. Consumer spending, which accounts for more than half of the economy, had the biggest decline in almost a decade.

Not only is the Japanese economy dependent on an export model, but it will actually start to shrink if exports lose momentum. So while this is not the full recovery everyone has been expecting, it is sustainable, just as long as the export growth continues. Quite a delicate situation, and one which explains the sensitivity of Japanese stocks and bonds to each and every jitter in the United States. Given that they are now becoming more and more dependent on Europe, I guess the sustainability of Germany's recovery is now also very much a matter of concern to them.

More Thoughts On Emerging Markets

The Financial Times has another fascinating story today about how yield-differentials on emerging market debt are once more back at historic lows (see my other posts on this over the last few days):

Risk premiums for emerging market bonds fell to match their record low on Wednesday, only two days after the shock imposition of capital controls in Thailand reminded investors of the potential risks associated with the sector.

Investors measure the risk of emerging market debt by comparing their yields with those of US Treasuries, seen as the safest sovereign bonds. As measured by JPMorgan’s EMBI+, a benchmark indicator, that spread fell on Wednesday to 172 basis points – one basis point is equal to 1/100th of a percentage point – over US Treasuries, equalling a record low hit last in May.

So we are back where we were in May: before Iceland, Turkey, Hungary etc.

And why, may we ask, is this? Well, first of all let's look at this problem the other way round: why did they start to widen in the first place?

The EMBI+ last reached a record tight level of 172bp on May 1. The spread subsequently widened to 238 basis points by June 27, as investors worried that central banks were poised to tighten monetary policy more aggressively as oil prices approached $80 a barrel.

So we need to think about two things, oil prices and central bank tightening. Well oil prices have now stabilized somewhat (although if growth really takes off again somewhere they won't stay at this level for long), and equally importantly, despite the fact that Trichet promises to be extremely vigilant (although in December he was perhaps promising this a little less forcefully than he had been) the markets appear to be taking the view that the better part of this raising cycle may now well be over, and the real debate is moving to how soon rates in the OECD world will come down, and when they do do so, how fast will they fall.

Obviously Japan is going to be a key test case here, since if the BoJ cannot raise, or can only manage a belated token quarter point, the implications will be quite significant. While the jury is still out, noone seems to anticipate any large raise in the foreseeable future.

So where does that leave us? Well back with the attractiveness of emerging market debt, that's where it leaves us.

Analysts attribute the bullish performance in emerging markets to strong demand by investors hungry for yield. The class has become attractive as economies have improved in recent years, partly on the boom in commodity prices.

Now this last, lone little paragraph, in fact contains three very important points:

a) Pension funds are growing, so the need to find better yield than US treasuries only grows with them. As I keep saying I think low yield rather than the meltdown of anything is going to be the big pensions issue.

2) Emerging markets are growing as a whole slew of countries pass through their Demographic Dividend, while the low fertility culture spreads even faster than anyone ever imagined (globalisation and behavioural changes).

c) The commodities countries ride on the back of the other two, but again there are even more feedback mechanisms at work

So the big point is, if interest rates in the developed world start to trend down, then interest payments in India (and elsewhere) will also do so, which will indirectly aid productivity growth, since effectively capital deepening will get cheaper, apart from all those funds flooding in hungry for yield.

Now one last issue occurs to me, but this is more in the form of a question than anything. Thinking about it, isn't there a danger of this whole thing tipping over at some point, or at least of a tipping point being reached?

I mean, lets imagine that investors are not totally stupid, and that they do want to make money (innocent enough assumptions I would think).

So, even with all the froth, property in Delhi and Shanghai has certainly got a lot more to offer over the next 10 to 15 years in the way of return than property in Barcelona or London. Not only that, the respective currencies are going to rise significantly (Brad is certainly right here, Bretton Woods II is not sustainable indefinitely in these circumstances). On top of this a big chunk of the emerging world is now about to become a sure bet. I mean the risk of instability could be much greater in Italy or Japan in a not too distant future. So when markets finally wise up to this posibility, what the hell is going to happen? Could we see a higher risk premium being demanded for some developed economies? And if this outcome were to happen, just how far are we away from such a point?

One last untimely thought: what would be really interesting would be to understand the social/economic mechanisms by which India and China got to have such a large population, and what connection (if any) did this population explosion have with the early rapid growth of the now developed world. After all it is the sheer size of these two countries which now is going to produce all the turbulence, and while all that anti-imperialist stuff we still hear about in India may be just so much nonsense, there may actually be feedback mechanisms to be identified somewhere along the line here. I mean it may be more than mere coincidence that some get caught in a poverty trap that produces only children while others take off, but if there is a mechanism, what the hell does it look like?

Risk premiums for emerging market bonds fell to match their record low on Wednesday, only two days after the shock imposition of capital controls in Thailand reminded investors of the potential risks associated with the sector.

Investors measure the risk of emerging market debt by comparing their yields with those of US Treasuries, seen as the safest sovereign bonds. As measured by JPMorgan’s EMBI+, a benchmark indicator, that spread fell on Wednesday to 172 basis points – one basis point is equal to 1/100th of a percentage point – over US Treasuries, equalling a record low hit last in May.

So we are back where we were in May: before Iceland, Turkey, Hungary etc.

And why, may we ask, is this? Well, first of all let's look at this problem the other way round: why did they start to widen in the first place?

The EMBI+ last reached a record tight level of 172bp on May 1. The spread subsequently widened to 238 basis points by June 27, as investors worried that central banks were poised to tighten monetary policy more aggressively as oil prices approached $80 a barrel.

So we need to think about two things, oil prices and central bank tightening. Well oil prices have now stabilized somewhat (although if growth really takes off again somewhere they won't stay at this level for long), and equally importantly, despite the fact that Trichet promises to be extremely vigilant (although in December he was perhaps promising this a little less forcefully than he had been) the markets appear to be taking the view that the better part of this raising cycle may now well be over, and the real debate is moving to how soon rates in the OECD world will come down, and when they do do so, how fast will they fall.

Obviously Japan is going to be a key test case here, since if the BoJ cannot raise, or can only manage a belated token quarter point, the implications will be quite significant. While the jury is still out, noone seems to anticipate any large raise in the foreseeable future.

So where does that leave us? Well back with the attractiveness of emerging market debt, that's where it leaves us.

Analysts attribute the bullish performance in emerging markets to strong demand by investors hungry for yield. The class has become attractive as economies have improved in recent years, partly on the boom in commodity prices.

Now this last, lone little paragraph, in fact contains three very important points:

a) Pension funds are growing, so the need to find better yield than US treasuries only grows with them. As I keep saying I think low yield rather than the meltdown of anything is going to be the big pensions issue.

2) Emerging markets are growing as a whole slew of countries pass through their Demographic Dividend, while the low fertility culture spreads even faster than anyone ever imagined (globalisation and behavioural changes).

c) The commodities countries ride on the back of the other two, but again there are even more feedback mechanisms at work

So the big point is, if interest rates in the developed world start to trend down, then interest payments in India (and elsewhere) will also do so, which will indirectly aid productivity growth, since effectively capital deepening will get cheaper, apart from all those funds flooding in hungry for yield.

Now one last issue occurs to me, but this is more in the form of a question than anything. Thinking about it, isn't there a danger of this whole thing tipping over at some point, or at least of a tipping point being reached?

I mean, lets imagine that investors are not totally stupid, and that they do want to make money (innocent enough assumptions I would think).

So, even with all the froth, property in Delhi and Shanghai has certainly got a lot more to offer over the next 10 to 15 years in the way of return than property in Barcelona or London. Not only that, the respective currencies are going to rise significantly (Brad is certainly right here, Bretton Woods II is not sustainable indefinitely in these circumstances). On top of this a big chunk of the emerging world is now about to become a sure bet. I mean the risk of instability could be much greater in Italy or Japan in a not too distant future. So when markets finally wise up to this posibility, what the hell is going to happen? Could we see a higher risk premium being demanded for some developed economies? And if this outcome were to happen, just how far are we away from such a point?

One last untimely thought: what would be really interesting would be to understand the social/economic mechanisms by which India and China got to have such a large population, and what connection (if any) did this population explosion have with the early rapid growth of the now developed world. After all it is the sheer size of these two countries which now is going to produce all the turbulence, and while all that anti-imperialist stuff we still hear about in India may be just so much nonsense, there may actually be feedback mechanisms to be identified somewhere along the line here. I mean it may be more than mere coincidence that some get caught in a poverty trap that produces only children while others take off, but if there is a mechanism, what the hell does it look like?

Wednesday, December 20, 2006

Japan: Fiscal Tightening Ahead

Koji Omi, Japan's finance minister, claimed yesterday that the gross domestic product deflator - an important measure of deflation - would turn positive in the year to March 2008 for the first time in a decade:

“The GDP deflator for the current fiscal year was minus 0.4 per cent, and that will become plus 0.2 per cent in fiscal 2007/08,” he said. “That shows the economy will become normal.”

Not everyone is completely convinced however:

Robert Feldman, economist at Morgan Stanley, said the disappearance of deflation as measured by the GDP deflator would be an important moment if it came true. However, he said that five years of economic growth were feeding through more slowly than expected into inflationary pressure.

This is just the point. As I have been arguing, consumer demand is proving to be much weaker than might have been expected, and this is raising doubts whether Japan can, finally, escape deflation.

Inflation has yet top break the 1% mark, and the yen is running still at historic lows against the euro, and is fairly weak against the dollar, both circumstances which are likely to be inflation positive.

At the same time Prime Minister Shinzo Abe seems determined to try to move forward to address the government debt situation, so that may well help explain the reluctance, commented on yesterday, of the BoJ to raise interest rates.

In fact the cuts they are looking at are no mere trifle:

Japan's government may eliminate its budget deficit earlier than the target date of 2011, Finance Minister Koji Omi said, confirming Prime Minister Shinzo Abe's commitment to cutting the world's largest public debt.

``If we just persist a little longer we may even be able to come in ahead of schedule,'' Omi said today in Tokyo after his ministry proposed reducing new bond sales by a record and curbing spending on public works in the year starting April 1.

The so-called primary deficit, the gap between revenue without new bond sales and annual spending excluding interest payment on debt, will decline to 4.4 trillion yen in fiscal 2007 from 11.2 trillion yen this year, improving for a fourth year. The government in July said it wants to eliminate the primary deficit by 2011 to stop the public debt from expanding.

So they would be aiming to make 7 trillion yen of savings in one fiscal year. Since this saving is only to come from a reduction in borrowing, and since interest rates are still only at 0.25% (and thus could not be claimed to have been excessively driven up by government borrowing), it is hard to see where the uptick in demand is going to come from to compensate for the cuts.

So it is hard to see the BoJ being especially vigorous with trying to raise rates, and it is hard to see where the inflationary pressure they are going to need to get themselves out of the mire of deflation is actually going to come from.

“The GDP deflator for the current fiscal year was minus 0.4 per cent, and that will become plus 0.2 per cent in fiscal 2007/08,” he said. “That shows the economy will become normal.”

Not everyone is completely convinced however:

Robert Feldman, economist at Morgan Stanley, said the disappearance of deflation as measured by the GDP deflator would be an important moment if it came true. However, he said that five years of economic growth were feeding through more slowly than expected into inflationary pressure.

This is just the point. As I have been arguing, consumer demand is proving to be much weaker than might have been expected, and this is raising doubts whether Japan can, finally, escape deflation.

Inflation has yet top break the 1% mark, and the yen is running still at historic lows against the euro, and is fairly weak against the dollar, both circumstances which are likely to be inflation positive.

At the same time Prime Minister Shinzo Abe seems determined to try to move forward to address the government debt situation, so that may well help explain the reluctance, commented on yesterday, of the BoJ to raise interest rates.

In fact the cuts they are looking at are no mere trifle:

Japan's government may eliminate its budget deficit earlier than the target date of 2011, Finance Minister Koji Omi said, confirming Prime Minister Shinzo Abe's commitment to cutting the world's largest public debt.

``If we just persist a little longer we may even be able to come in ahead of schedule,'' Omi said today in Tokyo after his ministry proposed reducing new bond sales by a record and curbing spending on public works in the year starting April 1.

The so-called primary deficit, the gap between revenue without new bond sales and annual spending excluding interest payment on debt, will decline to 4.4 trillion yen in fiscal 2007 from 11.2 trillion yen this year, improving for a fourth year. The government in July said it wants to eliminate the primary deficit by 2011 to stop the public debt from expanding.

So they would be aiming to make 7 trillion yen of savings in one fiscal year. Since this saving is only to come from a reduction in borrowing, and since interest rates are still only at 0.25% (and thus could not be claimed to have been excessively driven up by government borrowing), it is hard to see where the uptick in demand is going to come from to compensate for the cuts.

So it is hard to see the BoJ being especially vigorous with trying to raise rates, and it is hard to see where the inflationary pressure they are going to need to get themselves out of the mire of deflation is actually going to come from.

Tuesday, December 19, 2006

No Change At The Bank of Japan

Unsurprisingly, the Bank of Japan kept interest rates unchanged yesterday.The decision was unanimous. . Obviously that now opens the question as to whether they will in fact ever (in the short run I mean) be able to get round to raising. It depends on the external environment, and how much exporting they will be able to do in Q1 2007, I guess. But still they won't be going very far.

Bonds rose and the yen fell after Fukui said the bank wants to check more statistics on consumer spending and prices, which he described as ``somewhat weak.'' The bank isn't under pressure to raise rates because the economy, while in its longest expansion since World War II, grew at the slowest pace in almost two years last quarter.

``Fukui admitted that the some sectors of the economy, such as spending, are weak,'' said Hitomi Kimura, a bond strategist in Tokyo at JPMorgan Securities Japan Co. ``Such comments reduced expectations for higher rates.''

The yield on the benchmark 10-year bond fell 5 basis points to 1.63 percent at 5:54 p.m. in Tokyo. The yen declined to 118.12 per dollar from 117.92 before the announcement the key lending rate would be unchanged.

Tankan Report

The yen had its biggest drop in four months last week as reports, including the Tankan survey of business confidence, failed to provide enough evidence that the economy is accelerating.

The Tankan survey released last week showed confidence among large manufacturers rose to a two-year high and companies increased their forecasts for spending, profit and sales. They also said production capacity was the tightest since 1991 amid the most severe labor shortages in 14 years.

That survey wasn't enough to allay concern that the economy is slowing that followed the third-quarter gross domestic product report. The economy grew at an annual 0.8 percent pace in the period, less than half the government's initial estimate, as consumer spending slumped.

Meantime Cluas Vistesen has another timely post digging a bit deeper into the Japan phenomenon.

Bonds rose and the yen fell after Fukui said the bank wants to check more statistics on consumer spending and prices, which he described as ``somewhat weak.'' The bank isn't under pressure to raise rates because the economy, while in its longest expansion since World War II, grew at the slowest pace in almost two years last quarter.

``Fukui admitted that the some sectors of the economy, such as spending, are weak,'' said Hitomi Kimura, a bond strategist in Tokyo at JPMorgan Securities Japan Co. ``Such comments reduced expectations for higher rates.''

The yield on the benchmark 10-year bond fell 5 basis points to 1.63 percent at 5:54 p.m. in Tokyo. The yen declined to 118.12 per dollar from 117.92 before the announcement the key lending rate would be unchanged.

Tankan Report

The yen had its biggest drop in four months last week as reports, including the Tankan survey of business confidence, failed to provide enough evidence that the economy is accelerating.

The Tankan survey released last week showed confidence among large manufacturers rose to a two-year high and companies increased their forecasts for spending, profit and sales. They also said production capacity was the tightest since 1991 amid the most severe labor shortages in 14 years.

That survey wasn't enough to allay concern that the economy is slowing that followed the third-quarter gross domestic product report. The economy grew at an annual 0.8 percent pace in the period, less than half the government's initial estimate, as consumer spending slumped.

Meantime Cluas Vistesen has another timely post digging a bit deeper into the Japan phenomenon.

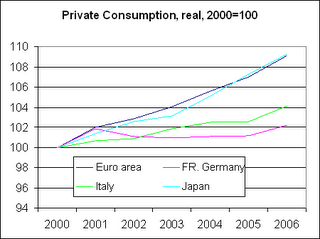

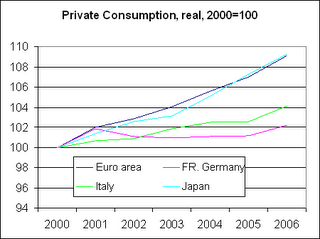

Private Consumption in Italy, Germany and Japan

Following a short debate in comments on this post, Sebastian Dullien of Eurozone Watch blog mailed me the following chart for private consumption 2000 - 2006 for Germany, Japan, Italy and the Eurozone. Curiously Japanese consumption (which is far from strong) is near the eurozone average (which of course incorporates Italy and Germany). As Sebastian notes (see below) "consumption growth in Germany since 2000 has been less than a fourth of that in Japan and only half of that in Italy".

Clearly there are more factors than simply the demographic ones at work here (latent German pessimism?), but all of this is certainly taking the debate into the right ballpark.

Here is Sebastian's full e-mail:

Dear Ed,

as I do not know how to post graphs in a comment, here my comment by e-mail:

You might be right that demographics plays a role in the consumption behaviour – something you can see also when looking at individual cases. This is indeed a very important issue, which has largely been neglected.

However, it seems to me that consumption in Germany has been much weaker than what can be explained by demographics alone. You quote yourself statistics that the median age in Italy, Germany and Japan are about the same. However, consumption growth in Germany since 2000 has been less than a fourth of that in Japan and only half of that in Italy (data from EU commission) In order to get a decent growth performance, Germany does not need a consumption growth in the magnitude of that of the US, but if our consumption had grown with the same speed as Japan’s, without any multiplier effects, average GDP growth over the past six years would have been 0.6 percentage points higher.

Incidentally Sebastian, I don't think the issue of graphs in comments is a question of your knowledge. My impression is that blog hasn't quite got there yet, but doubtless it will come. Thanks all the same.

Clearly there are more factors than simply the demographic ones at work here (latent German pessimism?), but all of this is certainly taking the debate into the right ballpark.

Here is Sebastian's full e-mail:

Dear Ed,

as I do not know how to post graphs in a comment, here my comment by e-mail:

You might be right that demographics plays a role in the consumption behaviour – something you can see also when looking at individual cases. This is indeed a very important issue, which has largely been neglected.

However, it seems to me that consumption in Germany has been much weaker than what can be explained by demographics alone. You quote yourself statistics that the median age in Italy, Germany and Japan are about the same. However, consumption growth in Germany since 2000 has been less than a fourth of that in Japan and only half of that in Italy (data from EU commission) In order to get a decent growth performance, Germany does not need a consumption growth in the magnitude of that of the US, but if our consumption had grown with the same speed as Japan’s, without any multiplier effects, average GDP growth over the past six years would have been 0.6 percentage points higher.

Incidentally Sebastian, I don't think the issue of graphs in comments is a question of your knowledge. My impression is that blog hasn't quite got there yet, but doubtless it will come. Thanks all the same.

Productivity Miracle In India?

Indian Economy Blog's great new find Nanubhai, has a most enlightening post up about tend growth and productivity in India. One to watch.

Back in the late 1990s, economists were trying to figure out what it was that led to the secular acceleration of economic growth in the United States: the longest and largest peace-time economic expansion in the 20th century (see footnotes). How was it that a country could grow so much and for so long without causing inflation and overcapacity? Was the business cycle dead?

During the boom, the US economy benefited from an unprecedented acceleration in productivity growth. This was driven primarily by the efficiencies created by technological and financial deepening – particularly in the retail, wholesale, electronics, semiconductors, and financial services industries. While the dot-com’s and Stanford techies in pastel suits got the glory, the economy itself was being powered by the Wal-Marts, Intels, and GEs – who were innovating rapidly – and implementing that innovation in long-term strategies to enhance their bottom line.

Now before I get to how this compares to India today, a brief economics refresher.

continue reading

Back in the late 1990s, economists were trying to figure out what it was that led to the secular acceleration of economic growth in the United States: the longest and largest peace-time economic expansion in the 20th century (see footnotes). How was it that a country could grow so much and for so long without causing inflation and overcapacity? Was the business cycle dead?

During the boom, the US economy benefited from an unprecedented acceleration in productivity growth. This was driven primarily by the efficiencies created by technological and financial deepening – particularly in the retail, wholesale, electronics, semiconductors, and financial services industries. While the dot-com’s and Stanford techies in pastel suits got the glory, the economy itself was being powered by the Wal-Marts, Intels, and GEs – who were innovating rapidly – and implementing that innovation in long-term strategies to enhance their bottom line.

Now before I get to how this compares to India today, a brief economics refresher.

continue reading

Brad Setser, The Times They Are A Changin, And How!

Brad Setser has a post today about the Thai Baht issue I mentioned yesterday. As Brad Says, a sign of the times, Jimmy, a sign of the times:

In 1998, Russia defaulted after Treasury Secretary Robert Rubin refused to throw good money after bad, and blocked NSC pressure to continue disburse more than $5b of the IMF's $15b credit line to Russia. In 2006, Russia added over $100b to its reserves even as it repaid almost $25b of debt to Germany and a host of other official creditors.

RGE Media Center

In 1998, credit spreads blew out. Volatility went crazy too. In 2006, credit spreads collapsed. Volatility fell to record low -- some would say crazy low -- levels.

In 1998, private capital flowed out of emerging economies in a big way. In 2006, private capital flowed into emerging economies in an even bigger way. Into emerging market funds. But also into emerging economies -- and specifically into the coffers of emerging market central banks.

In 1998, an Asian emerging economy facing responded to pressure on its currency by imposing draconian capital controls. Well, that hasn't changed. In 2006, another Asian emerging economy responded to pressure on its currency by imposing draconian capital controls.

Back in 1998, Malaysia was worried that speculative pressure was driving the ringgit down too far and too fast. Thailand, by contrast, is currently worried that speculative pressure is driving the baht up too far and too fast.

A sign of the times.

So Ok, we know that the weather has changed - since money is now fleeing into emerging economies and not out of them (see eg the comments on this post on property in India) - the question is what drives the weather. Whoever gets to understand that will have understood a lot.

Update

The Thai government have now revoked the main part of the measure. The reaction was just too fierce for them, but this still leaves the question of why funds are flowing in this direction, and why it is proving so hard to stem the flow.

Thailand was forced into revoking draconian controls on equity investment one day after imposing them, after Bangkok stocks suffered their biggest drop since 1990.

The country’s benchmark SET stock index plunged as much as 18 per cent as investors rushed to dump holdings. The SET recovered slightly to end 15 per cent down at 622.14 but the sell-off wiped Bt773.63bn ($22bn) off the index’s value.

The controls aimed to force offshore investors to keep their money in the country for at least a year or face stiff penalties for early withdrawal and are aimed at dampening speculation that has sent the currency 17 per cent higher against the dollar this year.

Mr Pridiyathorn earlier called the decision on capital controls an “historic” effort to counter speculation. The baht’s sharp rise this year - more than any other Asian currency - has caused Thai exporters to suffer in overseas markets.

In 1998, Russia defaulted after Treasury Secretary Robert Rubin refused to throw good money after bad, and blocked NSC pressure to continue disburse more than $5b of the IMF's $15b credit line to Russia. In 2006, Russia added over $100b to its reserves even as it repaid almost $25b of debt to Germany and a host of other official creditors.

RGE Media Center

In 1998, credit spreads blew out. Volatility went crazy too. In 2006, credit spreads collapsed. Volatility fell to record low -- some would say crazy low -- levels.

In 1998, private capital flowed out of emerging economies in a big way. In 2006, private capital flowed into emerging economies in an even bigger way. Into emerging market funds. But also into emerging economies -- and specifically into the coffers of emerging market central banks.

In 1998, an Asian emerging economy facing responded to pressure on its currency by imposing draconian capital controls. Well, that hasn't changed. In 2006, another Asian emerging economy responded to pressure on its currency by imposing draconian capital controls.

Back in 1998, Malaysia was worried that speculative pressure was driving the ringgit down too far and too fast. Thailand, by contrast, is currently worried that speculative pressure is driving the baht up too far and too fast.

A sign of the times.

So Ok, we know that the weather has changed - since money is now fleeing into emerging economies and not out of them (see eg the comments on this post on property in India) - the question is what drives the weather. Whoever gets to understand that will have understood a lot.

Update

The Thai government have now revoked the main part of the measure. The reaction was just too fierce for them, but this still leaves the question of why funds are flowing in this direction, and why it is proving so hard to stem the flow.

Thailand was forced into revoking draconian controls on equity investment one day after imposing them, after Bangkok stocks suffered their biggest drop since 1990.

The country’s benchmark SET stock index plunged as much as 18 per cent as investors rushed to dump holdings. The SET recovered slightly to end 15 per cent down at 622.14 but the sell-off wiped Bt773.63bn ($22bn) off the index’s value.

The controls aimed to force offshore investors to keep their money in the country for at least a year or face stiff penalties for early withdrawal and are aimed at dampening speculation that has sent the currency 17 per cent higher against the dollar this year.

Mr Pridiyathorn earlier called the decision on capital controls an “historic” effort to counter speculation. The baht’s sharp rise this year - more than any other Asian currency - has caused Thai exporters to suffer in overseas markets.

Monday, December 18, 2006

Europe's Trade Deficit With China

Brad Setser is almost certainly right to keep drawing our attention to the way in which the rise in the Euro has lead to an increased inflow of Chinese goods. Today there is news that Europe's trade deficit with China surged 19 percent year-on-year in the nine months up to September. This is a pretty hefty rate of increase:

The trade deficit with China grew to 63.4 billion euros ($83 billion) in the nine-month period, the European Union's statistics office said today. China is poised to overtake the U.S. this year as the second-biggest source of imports to the euro area, behind the U.K.

The statistics office also said today that the euro area's overall surplus narrowed to a seasonally adjusted 1.7 billion euros in October from a revised 2.4 billion euros the previous month.

And with Germany's exports increasing at a whopping rate, this means that someone else's deficit is taking something of a beating.

Also note that China is not alone in benefiting:

Imports from Japan to the euro region increased 6.7 percent to 41.6 billion euros in the nine-month period. The trade gap with Japan widened 17 percent to 16.2 billion euros.

All those surplus German savings which are getting recycled in the eurozone are it seems indirectly helping Japan with its weak internal consumption problem.

The trade deficit with China grew to 63.4 billion euros ($83 billion) in the nine-month period, the European Union's statistics office said today. China is poised to overtake the U.S. this year as the second-biggest source of imports to the euro area, behind the U.K.

The statistics office also said today that the euro area's overall surplus narrowed to a seasonally adjusted 1.7 billion euros in October from a revised 2.4 billion euros the previous month.

And with Germany's exports increasing at a whopping rate, this means that someone else's deficit is taking something of a beating.

Also note that China is not alone in benefiting:

Imports from Japan to the euro region increased 6.7 percent to 41.6 billion euros in the nine-month period. The trade gap with Japan widened 17 percent to 16.2 billion euros.

All those surplus German savings which are getting recycled in the eurozone are it seems indirectly helping Japan with its weak internal consumption problem.

Capital Flows In Thailand

This news is pretty incredible really.:

Thailand's regulators required banks to lock up 30 percent of new foreign currency deposits for a year to stop investors speculating on gains in the baht.

Overseas investors buying baht from tomorrow will only be able to recoup all of their funds if they keep the money in Thailand for more than a year, central bank Governor Tarisa Watanagase told a briefing in Bangkok today. Those who withdraw the reserved amount in less than a year will be penalized 33 percent of that portion, she said.

``They're getting pretty aggressive, as when a central bank starts withholding money it's pretty serious,'' said Steve Rowles, a Hong Kong-based analyst at CFC Seymour Ltd. ``This is really going to put the breaks on the baht.''

So now we have capital controls, not to stem an outflow of foreign exchange, but to stop an outflow of domestic currency. Oh how the world has changed.

Of course, it should escape no-ones notice that with fertility now well below replacement (somewhere in the 1.6 tfr range) Thailand is now right in the middle of that Demographic Dividend/Demographic Transition process I keep talking about.

Now for some more from Bloomberg:

The baht has risen about 16 percent this year to a nine- year high as the economy accelerated and a Sept. 19 coup broke a political stalemate. Exporters including Thai Union Frozen Products Pcl, the world's second-biggest tuna canner, on Nov. 16 asked the central bank to stem baht gains that are undermining their competitiveness.

The baht slipped almost 0.8 percent to 35.53 against the dollar as of 5:24 p.m. in Bangkok, the most in almost three months. It earlier climbed as much as 0.5 percent to 35.08, the highest since Oct. 7, 1997, according to data compiled by Bloomberg.

A devaluation of the Thai baht from about 25 to the dollar was the trigger for a plunge in currencies and a collapse in banks around the region in 1997 and 1998. The Thai government has since sought to restrict inflows of foreign currency.

The baht, the third-best performer among the world's 71 most-active currencies, started slumping after Finance Minister Pridiyathorn Devakula said this afternoon the central bank would make a ``historic'' announcement. The rule applies to transactions worth more than $20,000.

A rising baht hurts exporters by cutting the value of their local currency-denominated profits and making their products more expensive compared with those of Asian rivals. China's yuan has added 3.1 percent against the dollar this year, Malaysia's ringgit has gained 6.3 percent and Singapore's dollar has climbed 7.9 percent.

The baht has appreciated even though the central bank earlier this month introduced measures to limit its gains. The monetary authority on December 4 asked companies and commercial lenders not to sell baht short-term debt securities to overseas investors.

Thailand's economy may expand 5 percent this year, exceeding an earlier estimate of as much as 4.7 percent and last year's pace of 4.5 percent, the government said on Dec. 4.

A military coup on Sept. 19 ousted prime Minister Thaksin Shinawatra and ended seven months of political turmoil. Prime Minister Surayud Chulanont, installed by the military junta after the coup, is planning record spending on roads, subways and other infrastructure projects.

Speculative cash has poured into Thailand this month. Foreign short-term inflows surged to $950 million a week in December, from an average of about $300 million a week in November, Tarisa said today.

Thailand's regulators required banks to lock up 30 percent of new foreign currency deposits for a year to stop investors speculating on gains in the baht.

Overseas investors buying baht from tomorrow will only be able to recoup all of their funds if they keep the money in Thailand for more than a year, central bank Governor Tarisa Watanagase told a briefing in Bangkok today. Those who withdraw the reserved amount in less than a year will be penalized 33 percent of that portion, she said.

``They're getting pretty aggressive, as when a central bank starts withholding money it's pretty serious,'' said Steve Rowles, a Hong Kong-based analyst at CFC Seymour Ltd. ``This is really going to put the breaks on the baht.''

So now we have capital controls, not to stem an outflow of foreign exchange, but to stop an outflow of domestic currency. Oh how the world has changed.

Of course, it should escape no-ones notice that with fertility now well below replacement (somewhere in the 1.6 tfr range) Thailand is now right in the middle of that Demographic Dividend/Demographic Transition process I keep talking about.

Now for some more from Bloomberg:

The baht has risen about 16 percent this year to a nine- year high as the economy accelerated and a Sept. 19 coup broke a political stalemate. Exporters including Thai Union Frozen Products Pcl, the world's second-biggest tuna canner, on Nov. 16 asked the central bank to stem baht gains that are undermining their competitiveness.

The baht slipped almost 0.8 percent to 35.53 against the dollar as of 5:24 p.m. in Bangkok, the most in almost three months. It earlier climbed as much as 0.5 percent to 35.08, the highest since Oct. 7, 1997, according to data compiled by Bloomberg.

A devaluation of the Thai baht from about 25 to the dollar was the trigger for a plunge in currencies and a collapse in banks around the region in 1997 and 1998. The Thai government has since sought to restrict inflows of foreign currency.

The baht, the third-best performer among the world's 71 most-active currencies, started slumping after Finance Minister Pridiyathorn Devakula said this afternoon the central bank would make a ``historic'' announcement. The rule applies to transactions worth more than $20,000.

A rising baht hurts exporters by cutting the value of their local currency-denominated profits and making their products more expensive compared with those of Asian rivals. China's yuan has added 3.1 percent against the dollar this year, Malaysia's ringgit has gained 6.3 percent and Singapore's dollar has climbed 7.9 percent.

The baht has appreciated even though the central bank earlier this month introduced measures to limit its gains. The monetary authority on December 4 asked companies and commercial lenders not to sell baht short-term debt securities to overseas investors.

Thailand's economy may expand 5 percent this year, exceeding an earlier estimate of as much as 4.7 percent and last year's pace of 4.5 percent, the government said on Dec. 4.

A military coup on Sept. 19 ousted prime Minister Thaksin Shinawatra and ended seven months of political turmoil. Prime Minister Surayud Chulanont, installed by the military junta after the coup, is planning record spending on roads, subways and other infrastructure projects.

Speculative cash has poured into Thailand this month. Foreign short-term inflows surged to $950 million a week in December, from an average of about $300 million a week in November, Tarisa said today.

Venezuela and The Euro

Funny things coincidences, they really are. I just went over to Brad Setser's blog to check a quote for my last post, and I noticed he had a new post on Venezuala's reserves, which was strange, since I had just been looking at a Bloomberg piece on the same topic. They do however seem to be taking slightly different angles on this.

Brad, for example, heads his piece:

"Isn't the surprise here that Venezuela still has 80% of its reserves in dollars?"

whilst the emphasis in the Bloomberg article is really that the US dollar is increasingly at risk by moves like those coming from Chavez.

Venezuelan leader Hugo Chavez is directing a growing share of the country's oil profits into euros as the dollar and crude prices fall.

The dollar, down 9.4 percent against the euro this year, may face more pressure in 2007 because Venezuela and oil producers from the United Arab Emirates to Indonesia plan to funnel more money into the single European currency.

Now Brad has actually been fairly skeptical all along about just how much central banks will actually diversify out of the dollar, and he is right so to be. At the end of the day business is business, and capital losses can be sustained if you leap the wrong way (or, fail to leap that is) as Brad doesn't tire of reminding us in the Chinese case.

But if, as Claus Vistesen points out, in the longer term - as we move away from Bretton Woods II - both the dollar and the euro (and for that matter the Yen) are likely to trend down, then the central banker's reserves problem is hardly a simple one. I wonder if Claus will soon have a post reminding us just what sort of capital losses the Banco Central de Venezuela might get into if Chavez's anti-US ardour leads them to go too heavy on Euros? And as he tells us in his most recent post, the Economist end of the dollar hegemony story is now very rapidly coming to look like yesterday's news. As he would probably tell us, it's the interest rate differential silly!

And now for a healthy extract from that Bloomberg article:

``The U.S. dollar has suffered a long process of deterioration,'' Domingo Maza Zavala, one of seven board members at the central bank of Venezuela, said in a Dec. 14 interview. ``The diversification strategy started this year.''

Banco Central de Venezuela has slashed the percentage of its $35.9 billion worth of reserves invested in dollars and gold to 80 percent from 95 percent a year ago, said Maza Zavala. The country, the world's fifth-largest oil supplier, has boosted its euro holdings to 15 percent, from less than 5 percent in the same period.

The dollar has slumped against the European currency in 2006 as growth in the euro region outpaced the U.S. for the first time in five years. It rebounded 0.7 percent last week to finish at $1.308 against the euro. The U.S. currency is little changed versus the yen this year, closing on Dec. 15 at 118.17 yen.

Bank Indonesia is boosting euro holdings, said Senior Deputy Governor Miranda S Goeltom in a Dec. 13 interview in Jakarta. Indonesia has $39.9 billion in reserves. Sultan Bin Nasser al- Suwaidi, the governor of the Central Bank of the UAE, last month said he was considering when to shift as much as 8 percent of the nation's $24.9 billion in reserves into euros.

The central banks are changing policy ``because the oil price has come down a long way and the U.S. dollar has been declining,'' said Michael Derks, chief markets strategist at Arch Financial Products LLP, a London-based hedge fund. ``The euro stands to benefit.''

The Organization of Petroleum Exporting Countries, which produces 40 percent of the world's crude oil, said at a Dec. 14 meeting in Abuja, Nigeria, that it would cut output by 500,000 barrels a day to boost prices. Crude gained 92 cents on Dec. 15 to $63.43, the highest close since Dec. 1. Prices have fallen from a high of $78.40 in mid-July.

Crude is priced in dollars and the U.S. is the biggest consumer, importing around $400 million worth of the fuel a day in 2005, according to data from BP Plc, Europe's second-biggest oil company.

The share of foreign-exchange deposits held in dollars by OPEC members and Russia, the largest non-OPEC oil exporter, fell to a two-year low of 65 percent during the second quarter, from 67 percent during the previous three months, Bank of International Settlements figures released last week show.

Venezuela may also be motivated by animosity toward the U.S., said Rick Arney, chief currency strategist in San Francisco at Barclays Global Investors, which manages $1.7 trillion in assets.

``There is a political overlay to all of this,'' said Arney. ``Buying the dollar is not politically popular for some of these folks.''

Chavez, re-elected as President for six years on Dec. 3, told the UN General Assembly on Sept. 20 that the U.S. is ``the greatest threat'' to the planet, and has repeatedly described U.S. President George W. Bush as ``the devil.'' He also says Bush's administration is trying to have him killed.

Chavez called on OPEC to sell oil denominated in euros rather than dollars at a meeting of the group in Caracas on June 1, supporting a proposal made by Iran.

Brad, for example, heads his piece:

"Isn't the surprise here that Venezuela still has 80% of its reserves in dollars?"

whilst the emphasis in the Bloomberg article is really that the US dollar is increasingly at risk by moves like those coming from Chavez.

Venezuelan leader Hugo Chavez is directing a growing share of the country's oil profits into euros as the dollar and crude prices fall.

The dollar, down 9.4 percent against the euro this year, may face more pressure in 2007 because Venezuela and oil producers from the United Arab Emirates to Indonesia plan to funnel more money into the single European currency.

Now Brad has actually been fairly skeptical all along about just how much central banks will actually diversify out of the dollar, and he is right so to be. At the end of the day business is business, and capital losses can be sustained if you leap the wrong way (or, fail to leap that is) as Brad doesn't tire of reminding us in the Chinese case.

But if, as Claus Vistesen points out, in the longer term - as we move away from Bretton Woods II - both the dollar and the euro (and for that matter the Yen) are likely to trend down, then the central banker's reserves problem is hardly a simple one. I wonder if Claus will soon have a post reminding us just what sort of capital losses the Banco Central de Venezuela might get into if Chavez's anti-US ardour leads them to go too heavy on Euros? And as he tells us in his most recent post, the Economist end of the dollar hegemony story is now very rapidly coming to look like yesterday's news. As he would probably tell us, it's the interest rate differential silly!

And now for a healthy extract from that Bloomberg article:

``The U.S. dollar has suffered a long process of deterioration,'' Domingo Maza Zavala, one of seven board members at the central bank of Venezuela, said in a Dec. 14 interview. ``The diversification strategy started this year.''

Banco Central de Venezuela has slashed the percentage of its $35.9 billion worth of reserves invested in dollars and gold to 80 percent from 95 percent a year ago, said Maza Zavala. The country, the world's fifth-largest oil supplier, has boosted its euro holdings to 15 percent, from less than 5 percent in the same period.

The dollar has slumped against the European currency in 2006 as growth in the euro region outpaced the U.S. for the first time in five years. It rebounded 0.7 percent last week to finish at $1.308 against the euro. The U.S. currency is little changed versus the yen this year, closing on Dec. 15 at 118.17 yen.

Bank Indonesia is boosting euro holdings, said Senior Deputy Governor Miranda S Goeltom in a Dec. 13 interview in Jakarta. Indonesia has $39.9 billion in reserves. Sultan Bin Nasser al- Suwaidi, the governor of the Central Bank of the UAE, last month said he was considering when to shift as much as 8 percent of the nation's $24.9 billion in reserves into euros.

The central banks are changing policy ``because the oil price has come down a long way and the U.S. dollar has been declining,'' said Michael Derks, chief markets strategist at Arch Financial Products LLP, a London-based hedge fund. ``The euro stands to benefit.''

The Organization of Petroleum Exporting Countries, which produces 40 percent of the world's crude oil, said at a Dec. 14 meeting in Abuja, Nigeria, that it would cut output by 500,000 barrels a day to boost prices. Crude gained 92 cents on Dec. 15 to $63.43, the highest close since Dec. 1. Prices have fallen from a high of $78.40 in mid-July.

Crude is priced in dollars and the U.S. is the biggest consumer, importing around $400 million worth of the fuel a day in 2005, according to data from BP Plc, Europe's second-biggest oil company.

The share of foreign-exchange deposits held in dollars by OPEC members and Russia, the largest non-OPEC oil exporter, fell to a two-year low of 65 percent during the second quarter, from 67 percent during the previous three months, Bank of International Settlements figures released last week show.

Venezuela may also be motivated by animosity toward the U.S., said Rick Arney, chief currency strategist in San Francisco at Barclays Global Investors, which manages $1.7 trillion in assets.

``There is a political overlay to all of this,'' said Arney. ``Buying the dollar is not politically popular for some of these folks.''

Chavez, re-elected as President for six years on Dec. 3, told the UN General Assembly on Sept. 20 that the U.S. is ``the greatest threat'' to the planet, and has repeatedly described U.S. President George W. Bush as ``the devil.'' He also says Bush's administration is trying to have him killed.

Chavez called on OPEC to sell oil denominated in euros rather than dollars at a meeting of the group in Caracas on June 1, supporting a proposal made by Iran.

Emerging Markets On The Up And Up

Well emerging markets are certainly rising again, and at a pretty hefty rate. This is, of course, pretty significant, and one of the reasons why I think India will see an investment boom next year (which means I pretty much disagree with this piece from Credit Suisse, since I think it will be the growth of investment rather than consumption in India which will be the big news in 2007).

Curiously Brad Setser is now using the expression savings glut (as in "And as China current account surplus has risen, it clearly become a big contributor to the global savings glut" - and this in a post specifically about Bernanke, has he finally crossed the Rubicon I ask myself):

Investors in emerging markets added more money to stock funds last week than at any time in seven months after record-breaking share rallies from China to Brazil pushed inflows for 2006 past last year's all-time high.

Funds investing in shares of developing countries attracted $1.65 billion more than they lost from redemptions in the week ended Dec. 13, figures from Emerging Portfolio Fund Research showed. The net fund inflow was the most since the weekly period ended May 10, when they drew $2.86 billion.

Investors have taken renewed interest in emerging-market funds, as faster economic growth and a boom in commodities demand propelled a rebound in shares of developing countries.

The Morgan Stanley Capital International Emerging Markets Index on Dec. 5 climbed past a record of 881.52 set on May 8. Today, the measure added 0.6 percent to 891.76 as 3:28 p.m. in New York.

The rally has helped the index recover all its losses after a 25 percent swoon in 26 days between May and June sent the measure to its 2006 low. Brazil, Russia, India and China, the so-called BRICs markets, have led the advance, with share indexes in each country setting records in the past two weeks.

The H share index of Hong Kong-listed Chinese companies that foreign investors can freely buy and sell has climbed 69 percent this year, while the dollar-denominated RTS Index has jumped 65 percent. In Index, the Sensitive Index has gained 45 percent and Brazil's Bovespa index has added 41 percent in dollar terms.

Among country funds, China-related funds attracted the most buying, adding more than $500 million in the week, according to Emerging Portfolio, a Cambridge, Massachusetts-based firm that tracks about 15,000 funds worldwide with $7 trillion in assets.

For the year, China funds have taken in about $9.5 billion more cash than they have paid out this year, almost half the total for all emerging-market stock funds and nearly quadruple the full-year record of $2.45 billion, set in 2003.

With about two weeks remaining in 2006, the funds have taken in $20.8 billion in a net basis, exceeding the record $20.3 billion they attracted in all of 2005. The amount is still less than the $32.9 billion the funds had attracted earlier this year, before the May-June slide caused investors to withdraw as much as $18 billion from the funds, on a net basis.

Curiously Brad Setser is now using the expression savings glut (as in "And as China current account surplus has risen, it clearly become a big contributor to the global savings glut" - and this in a post specifically about Bernanke, has he finally crossed the Rubicon I ask myself):

Investors in emerging markets added more money to stock funds last week than at any time in seven months after record-breaking share rallies from China to Brazil pushed inflows for 2006 past last year's all-time high.

Funds investing in shares of developing countries attracted $1.65 billion more than they lost from redemptions in the week ended Dec. 13, figures from Emerging Portfolio Fund Research showed. The net fund inflow was the most since the weekly period ended May 10, when they drew $2.86 billion.

Investors have taken renewed interest in emerging-market funds, as faster economic growth and a boom in commodities demand propelled a rebound in shares of developing countries.

The Morgan Stanley Capital International Emerging Markets Index on Dec. 5 climbed past a record of 881.52 set on May 8. Today, the measure added 0.6 percent to 891.76 as 3:28 p.m. in New York.

The rally has helped the index recover all its losses after a 25 percent swoon in 26 days between May and June sent the measure to its 2006 low. Brazil, Russia, India and China, the so-called BRICs markets, have led the advance, with share indexes in each country setting records in the past two weeks.

The H share index of Hong Kong-listed Chinese companies that foreign investors can freely buy and sell has climbed 69 percent this year, while the dollar-denominated RTS Index has jumped 65 percent. In Index, the Sensitive Index has gained 45 percent and Brazil's Bovespa index has added 41 percent in dollar terms.

Among country funds, China-related funds attracted the most buying, adding more than $500 million in the week, according to Emerging Portfolio, a Cambridge, Massachusetts-based firm that tracks about 15,000 funds worldwide with $7 trillion in assets.

For the year, China funds have taken in about $9.5 billion more cash than they have paid out this year, almost half the total for all emerging-market stock funds and nearly quadruple the full-year record of $2.45 billion, set in 2003.

With about two weeks remaining in 2006, the funds have taken in $20.8 billion in a net basis, exceeding the record $20.3 billion they attracted in all of 2005. The amount is still less than the $32.9 billion the funds had attracted earlier this year, before the May-June slide caused investors to withdraw as much as $18 billion from the funds, on a net basis.

Sunday, December 17, 2006

German Output and Exports

This is more like working notes than an analysis, but just to point out two things about the October data:

Firstly German industrial output fell in October:

German industrial production fell unexpectedly in October, with construction and energy output hardest hit, but economists said the data were probably a blip and that the outlook for the fourth quarter remained good.

Output declined in October by 1.4 percent month-on-month in seasonally adjusted terms, undershooting all forecasts, preliminary Economy Ministry data showed on Friday....

The output drop, the second monthly fall in succession, comes two days after data showed German manufacturing orders unexpectedly declined by 1.1 percent in October.

On the other hand:

The output figures contrasted with trade data from October released earlier on Friday. These showed Germany’s trade surplus hitting a record high, driven by strong demand for goods from around Europe, but especially from outside the European Union.

Indeed October seems to have been a really good month for German exports:

German exports unexpectedly rose for a fifth month in October, suggesting sales in Asia will help Europe's largest economy cope with a U.S. economic slowdown.

Exports climbed 2.6 percent from September, when they gained the most in more than four years, the Federal Statistics Office in Wiesbaden said today.

And just look at this:

Exports climbed 23 percent in October from a year earlier, with sales to countries outside the European Union jumping 31 percent, according to the statistics office.....Germany's trade surplus rose to 17.3 billion euros ($23 billion) in October from 15.6 billion euros a month earlier, the statistics office reported. Imports slipped 0.2 percent from the previous month.

The explanation for the difference between the industrial output performance and the strong export position is of course two fold:

1) In the first place there is a structural transition away from manufacturing and into services taking place.

2) In the second place domestic consumption still remains weak. October retail sales actually FELL year on year. In terms of my ageing society analysis this is hardly surprising:

German retail sales declined slightly in October, confounding expectations of rising consumer sentiment, according to government figures released Thursday.

Sales declined by 0.2 percent from September to October adjusted for calendar and seasonal effects, the Federal Statistics Office said. Compared with October 2005, sales declined by 0.8 percent.

So assuming that some of these sales were actually being brought forward from 2007 - to avoid the VAT rise - I'm really not sure I can agree at all with Sebastian Dullian at Eurozone Watch Blog when he says Honey, I shrunk the German VAT shock, since my feeling is that this is going to turn into a much bigger deal than most are imagining, and that when the shouting is all done, we will look at tax hikes as a means of addressing deficit problems in a very different light.

Firstly German industrial output fell in October:

German industrial production fell unexpectedly in October, with construction and energy output hardest hit, but economists said the data were probably a blip and that the outlook for the fourth quarter remained good.

Output declined in October by 1.4 percent month-on-month in seasonally adjusted terms, undershooting all forecasts, preliminary Economy Ministry data showed on Friday....

The output drop, the second monthly fall in succession, comes two days after data showed German manufacturing orders unexpectedly declined by 1.1 percent in October.

On the other hand:

The output figures contrasted with trade data from October released earlier on Friday. These showed Germany’s trade surplus hitting a record high, driven by strong demand for goods from around Europe, but especially from outside the European Union.

Indeed October seems to have been a really good month for German exports:

German exports unexpectedly rose for a fifth month in October, suggesting sales in Asia will help Europe's largest economy cope with a U.S. economic slowdown.

Exports climbed 2.6 percent from September, when they gained the most in more than four years, the Federal Statistics Office in Wiesbaden said today.

And just look at this:

Exports climbed 23 percent in October from a year earlier, with sales to countries outside the European Union jumping 31 percent, according to the statistics office.....Germany's trade surplus rose to 17.3 billion euros ($23 billion) in October from 15.6 billion euros a month earlier, the statistics office reported. Imports slipped 0.2 percent from the previous month.

The explanation for the difference between the industrial output performance and the strong export position is of course two fold:

1) In the first place there is a structural transition away from manufacturing and into services taking place.

2) In the second place domestic consumption still remains weak. October retail sales actually FELL year on year. In terms of my ageing society analysis this is hardly surprising:

German retail sales declined slightly in October, confounding expectations of rising consumer sentiment, according to government figures released Thursday.

Sales declined by 0.2 percent from September to October adjusted for calendar and seasonal effects, the Federal Statistics Office said. Compared with October 2005, sales declined by 0.8 percent.

So assuming that some of these sales were actually being brought forward from 2007 - to avoid the VAT rise - I'm really not sure I can agree at all with Sebastian Dullian at Eurozone Watch Blog when he says Honey, I shrunk the German VAT shock, since my feeling is that this is going to turn into a much bigger deal than most are imagining, and that when the shouting is all done, we will look at tax hikes as a means of addressing deficit problems in a very different light.

The Future of EU Accession

In general all of this is really starting to worry me. I had a couple of posts recently on Serbia's plight on demography matters (and here) and obviously the knock-on impacts of many future Iraq scenarios are not pleasant to contemplate, so really expansion wearying at this key moment in time could have quite important consequences:

EU to start closing doors to the east

European Union leaders will on Friday evening toughen up the rules on eastward expansion of the club, in an admission that public opinion in the west has turned sharply against taking in new members.

The rigorous new EU membership rules will be a dispiriting signal to countries such as Turkey, Serbia and Bosnia, which already believe their road to accession is littered with obstacles. However, a two-day European summit in Brussels will confirm that the Union will honour its offer of membership to Turkey and the countries of the western Balkans when they are ready – and if the EU is ready to take them in.

EU to start closing doors to the east

European Union leaders will on Friday evening toughen up the rules on eastward expansion of the club, in an admission that public opinion in the west has turned sharply against taking in new members.

The rigorous new EU membership rules will be a dispiriting signal to countries such as Turkey, Serbia and Bosnia, which already believe their road to accession is littered with obstacles. However, a two-day European summit in Brussels will confirm that the Union will honour its offer of membership to Turkey and the countries of the western Balkans when they are ready – and if the EU is ready to take them in.

Japanese Growth Revisited

This article on the downward revision of Japanese growth is a bit old now, but it does contain a few useful points:

Japan's economy grew at a far weaker pace in the third quarter than previously reported due to downward revisions in consumer spending and capital investment, the government said Friday, raising concerns about the recovery's strength. Gross domestic product expanded at an annual rate of 0.8 percent, well below the preliminary 2.0 percent announced in November, but marked the seventh straight quarter of expansion, the government said.

Since exports remained relatively strong, the big changes were a revision downwards of consumption and investment:

Domestic demand — which includes consumer spending, government spending and private investment — had contracted 0.2 percent from the previous quarter instead of inching up 0.1 percent, as previously thought.

Separately government data viewed as a key indicator for corporate investment, released Friday, showed core machinery orders rose a weaker-than-expected 2.8 percent in October from the previous month. That reversed September's 7.4 percent plunge but missed the forecasts by economists surveyed by Dow Jones Newswires for 5.7 percent growth.

The key to the picture would seem to be consumption, since the weak investment most likely is a by-product of an equally weak estimate of the likely direction of internal consumption:

Economy Minister Hiroko Ota blamed the downward

GDP revision mostly on weak consumer spending, but assured the public that Japan's economic revival was on track.

"The lower GDP was mainly caused by weak consumption," she said. "I don't have any concerns that the economy will fall into a downward trend. Nor do I see any signs of its entering a lull."

Although Japan's economy has been emerging from decade-long slowdown that ran through much of the 1990s, recent signs have underlined the risk that growth may be overly reliant on exports. Some analysts say the revival is dependent on U.S. and other overseas economies holding up.

Analysts also say paychecks and other realities that trickle down to workers don't reflect upbeat GDP numbers, as companies cut costs to keep up with global competition and the Japanese population ages and increasingly shifts to lower-paying jobs.

This weak consumption in Japan meme now seems to be catching on, as this article on the world economic outlook from AP this weekend seems to have already internalised the idea that Japanese consumption is the current big enigma:

Japan, Asia's largest economy, is steadily recovering from a decade of stagnation. However, consumer spending appears to be weakening, leaving the economy vulnerable to slowing demand for exports, its traditional source of growth.

Anyone interested in a fuller theoretical explanation as to why consumption is holding so weak could do worse than this post of mine, or this post from Claus Vistesen.

Japan's economy grew at a far weaker pace in the third quarter than previously reported due to downward revisions in consumer spending and capital investment, the government said Friday, raising concerns about the recovery's strength. Gross domestic product expanded at an annual rate of 0.8 percent, well below the preliminary 2.0 percent announced in November, but marked the seventh straight quarter of expansion, the government said.

Since exports remained relatively strong, the big changes were a revision downwards of consumption and investment:

Domestic demand — which includes consumer spending, government spending and private investment — had contracted 0.2 percent from the previous quarter instead of inching up 0.1 percent, as previously thought.

Separately government data viewed as a key indicator for corporate investment, released Friday, showed core machinery orders rose a weaker-than-expected 2.8 percent in October from the previous month. That reversed September's 7.4 percent plunge but missed the forecasts by economists surveyed by Dow Jones Newswires for 5.7 percent growth.

The key to the picture would seem to be consumption, since the weak investment most likely is a by-product of an equally weak estimate of the likely direction of internal consumption:

Economy Minister Hiroko Ota blamed the downward

GDP revision mostly on weak consumer spending, but assured the public that Japan's economic revival was on track.

"The lower GDP was mainly caused by weak consumption," she said. "I don't have any concerns that the economy will fall into a downward trend. Nor do I see any signs of its entering a lull."

Although Japan's economy has been emerging from decade-long slowdown that ran through much of the 1990s, recent signs have underlined the risk that growth may be overly reliant on exports. Some analysts say the revival is dependent on U.S. and other overseas economies holding up.

Analysts also say paychecks and other realities that trickle down to workers don't reflect upbeat GDP numbers, as companies cut costs to keep up with global competition and the Japanese population ages and increasingly shifts to lower-paying jobs.

This weak consumption in Japan meme now seems to be catching on, as this article on the world economic outlook from AP this weekend seems to have already internalised the idea that Japanese consumption is the current big enigma:

Japan, Asia's largest economy, is steadily recovering from a decade of stagnation. However, consumer spending appears to be weakening, leaving the economy vulnerable to slowing demand for exports, its traditional source of growth.

Anyone interested in a fuller theoretical explanation as to why consumption is holding so weak could do worse than this post of mine, or this post from Claus Vistesen.

Friday, December 15, 2006

China: Retail Sales and Industrial Output

Two interesting pieces of information from China this week. In the first place retail sales are growing fast:

China retail sales grew 14.1 percent in November from a year earlier as rising incomes spurred consumer spending in the world's fastest-growing major economy.

Sales rose to 682 billion yuan ($87 billion) after gaining 14.3 percent, the fastest pace in almost two years, in October, the Beijing-based National Bureau of Statistics said today. Economists surveyed by Bloomberg News expected growth to remain unchanged from October.